Transparency

Unlike typical “black-box” solutions for retail traders, StockSense discloses all trading signals and methodologies, along with source code documentation.

Consistency

Instead of touting the success of certain trading strategies for specific stocks, StockSense utilizes a consistent, simple and accessible user interface, allowing users to customize and evaluate the same trading strategies for multiple tickers and timeframes.

Data Driven

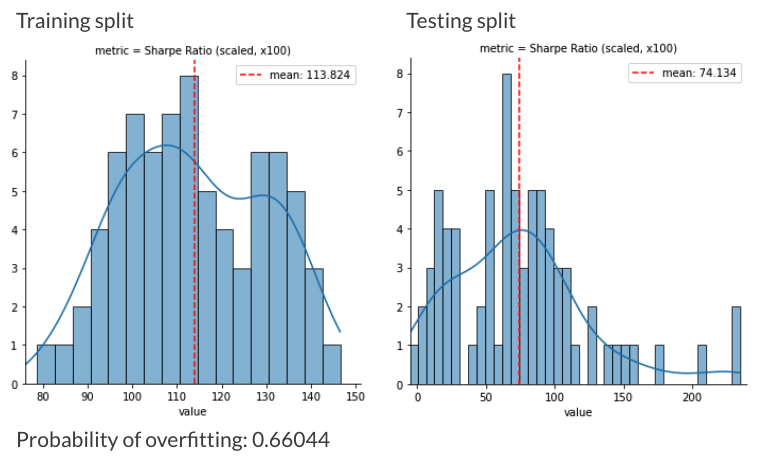

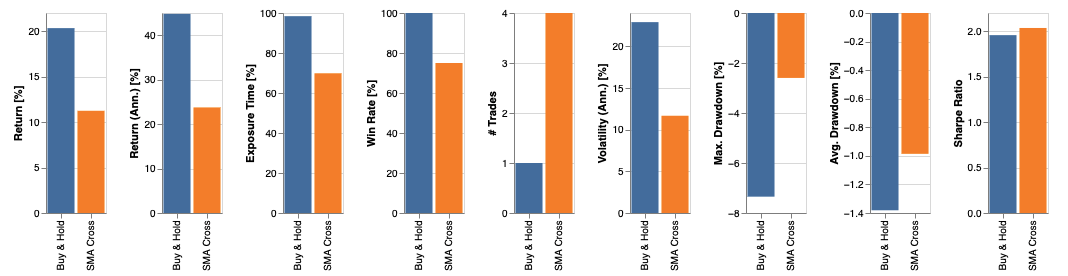

Avoiding heuristics and subjective pattern-reading from stock charts, reliability metrics on StockSense is based on statistical analysis and rigorous backtesting.

Why StockSense?

StockSense is built in response to the surging popularity of momentum trading among retail investors. Retail investors comprise approximately 20% of the trading volume in the US stock market today[1]. With the rise of commission-free trading platforms, social media and online forums focused on trading, the trading activities of retail investors are becoming an increasingly important driving force behind both stock market returns and volatility, as can be seen from the GameStop trading debacle in early 2021.

Technical analysis is often referenced in media and online trading forums targeted at retail investors as reasons to buy or sell a stock. Frequently, investment recommendations are given through subjective chart-reading without data-driven backup. Retail investors typically do not possess the financial or programming knowledge to properly assess the reliability of these trading strategies on their own, and could be vulnerable to financial losses from following such recommendations.

At StockSense, we believe it is important to educate retail traders on how to evaluate the reliability of technical trading strategies and provide them with the tools to test out strategies themselves. Our mission is to build a user-friendly platform that helps retail traders systematically evaluate trading strategies through backtesting, and statistical analysis, so retail investors could make more informed trading decisions.

How does StockSense work?

StockSense simplifies your due diligence when incorporating technical indicators into your decision making process. Simply input the ticker of your interest into the search bar, and it automatically backtest common technical indicators for your ticker.

Tunable parameters

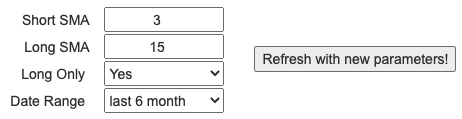

StockSense allows you to play with different parameters of the indicators. Look at how different parameters affect past performance of these indicators.

Interactive charting

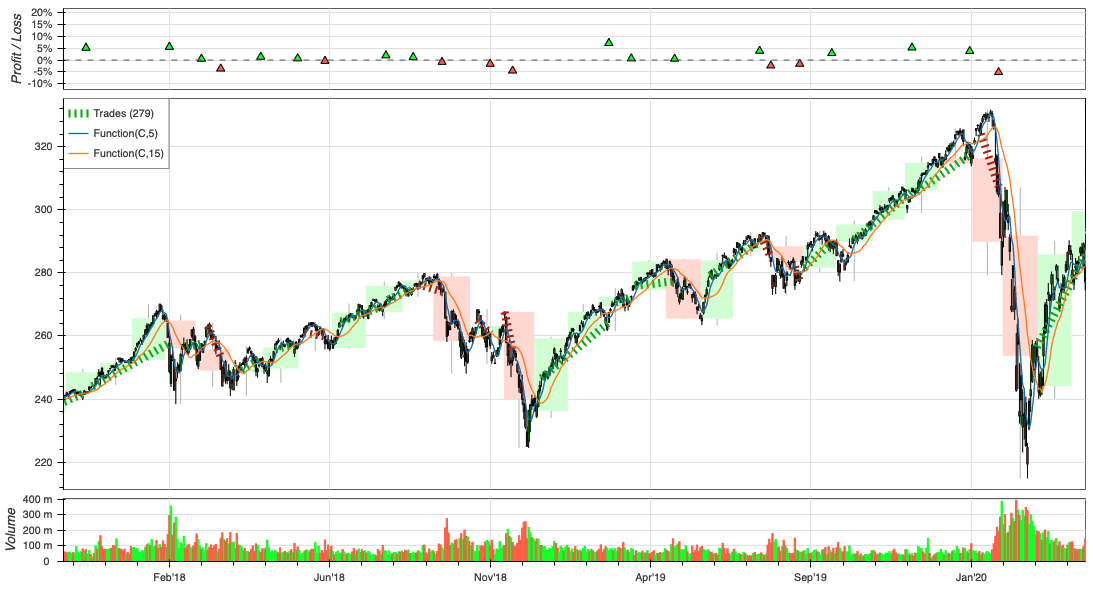

Investigate trends in historical data, and the trades made by the backtests, interactively.

Robust backtesting

In addition to backtesting over historical data, StockSense validate the reliability of these indicators through quantitative techniques. For more information on how this works, please refer to FAQ and Technical Details.